Did you know from 1 July 2017 the Federal Government is reducing the amount you can contribute to super each year? There has never been a better time to maximise your super.

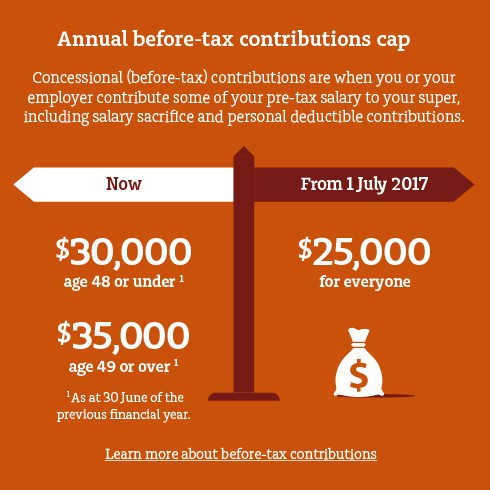

Make the most of the higher concessional contribution caps

Concessional (before tax) contributions are taxed in the super fund at a maximum rate of 15% (or 30% for some people who earn a high income1). This tax rate in super is likely to be lower than the marginal income tax rate of up to 49%2 that would be paid on salary or other sources of taxable income.

In the current financial year, these contributions are capped at $35,000 pa if you were 49 years of age or older on 30 June 2016 and $30,000 pa for everyone else.

From 1 July 2017, the cap reduces to $25,000 pa for everyone. If your cashflow allows, you may want to take advantage of the higher cap that applies until 30 June 2017.

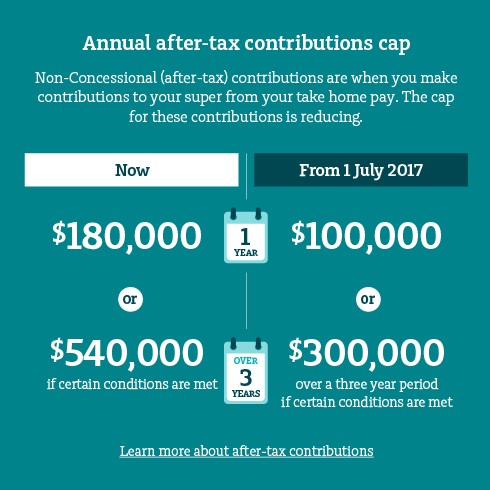

Maximise your non-concessional contributions before they come down

In the current financial year, non-concessional (after-tax) contributions are capped at $180,000 pa or $540,000 if you bring forward up to two years’ worth of contributions. Other conditions apply – visit ato.gov.au to find out more.

Broadly, from 1 July 2017, the maximum after-tax contributions you can make is $100,000 pa or $300,000 by bringing forward two years’ worth of contributions. Other conditions apply – visit ato.gov.au to find out more. However, after-tax contributions will not be able to be made if you have a total super balance3,4 over $1.6 million.

If you have sufficient money available that you would like to contribute to super, you may want to make after-tax contributions before 30 June 2017 to take advantage of the higher cap.

Important information

Before contributing to your super, you should consider the contributions you’ve already made in relation to the existing caps and seek further advice where required. Contact Proxima Financial Planning.

Source: MLC

1. Individuals with income and concessional contributions above $300,000 (in 2016/17) will pay an additional 15% tax on personal deductible and other concessional super contributions which place them in excess of the threshold. This income and concessional contribution threshold will reduce to $250,000 from 1 July 2017.

2. Includes Medicare levy and, for 2016/17, the Temporary Budget Repair levy of 2% on taxable income exceeding $180,000. Resident marginal tax rates can be found at www.ato.gov.au

3.If your total super balance is $1.6 million or more at 30 June 2017, your after-tax contributions cap balance will be reduced to nil from 1 July 2017.

4. Total superannuation balance includes superannuation savings in accumulation accounts and income streams.