by Proxima | Jun 24, 2019 | Uncategorized

New law changing the assets and income test treatment of lifetime income streams commenced on or after 1 July 2019 is an important consideration for pre and post retirees and could change your Age Pension and retirement income outcomes. The social security assets...

by Proxima | Jun 24, 2019 | Uncategorized

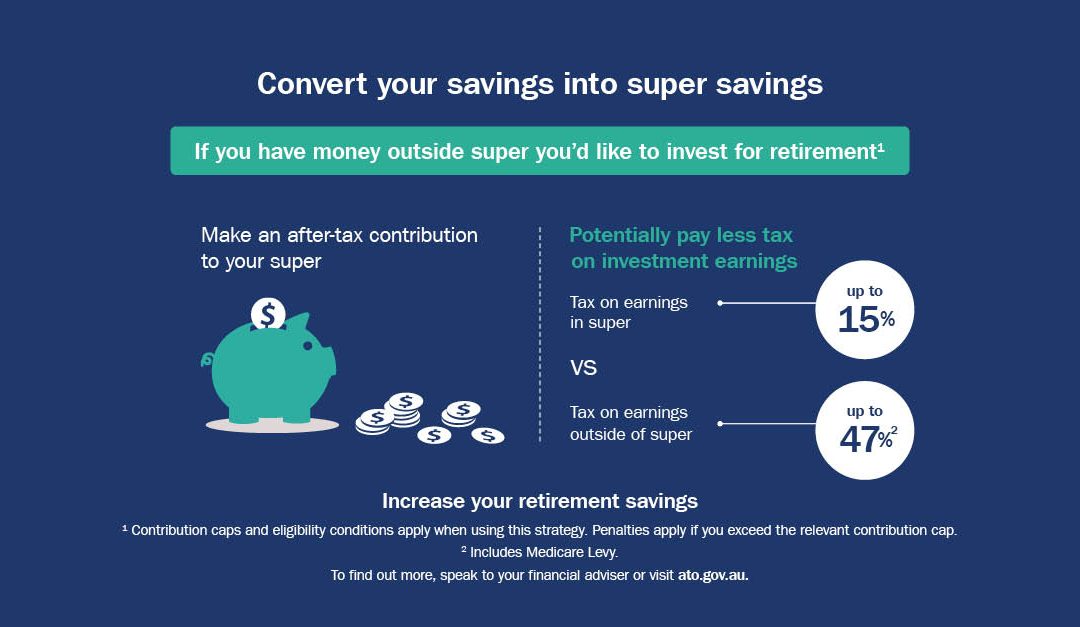

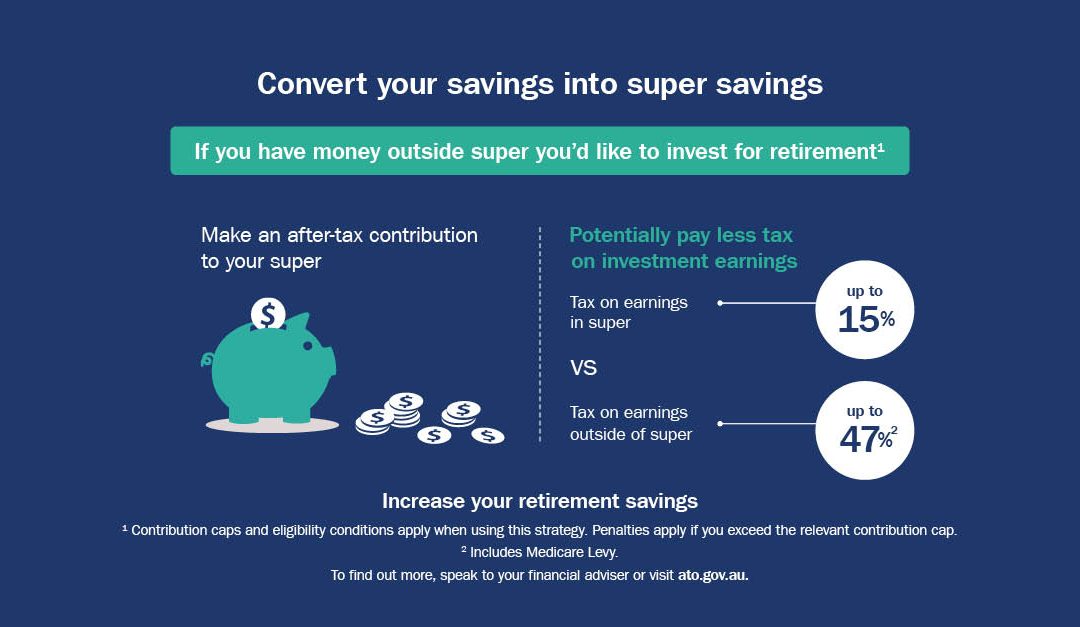

Want to help boost your retirement savings while potentially saving on tax? Here are five smart super strategies to consider before the end of the financial year. 1. Add to your super – and claim a tax deduction If you contribute some of your after-tax income or...

by Proxima | Apr 12, 2019 | Uncategorized

If you’re like many business owners you have already insured the physical assets of your business from theft, fire and damage. But have you considered the importance of insuring yourself – and other key people in your business – against the possibility of...

by Proxima | Apr 12, 2019 | Uncategorized

Latest figures show Australian men can expect to retire with over a third more super than women. So why does this happen and what can be done about it? Alison Fischer CFP® Private Client Adviser for Crosbie Wealth Management and mum-to-be, shares her thoughts on what...

by Proxima | Apr 12, 2019 | Uncategorized

Keeping busy with work and family year after year can make it tricky to decide how to spend time in retirement. Discover ways to feel your best and make the most of life after work. Keeping active According to research from Sydney University, people who have retired...

by Proxima | Apr 12, 2019 | Uncategorized

Want to boost your financial well-being without giving up completely on being spontaneous? Get on top of your finances and enjoy life more at the same time with our five step guide to living in the moment while saving for the future. Don’t be a slave to your savings...