Make tax-deductible super contributions

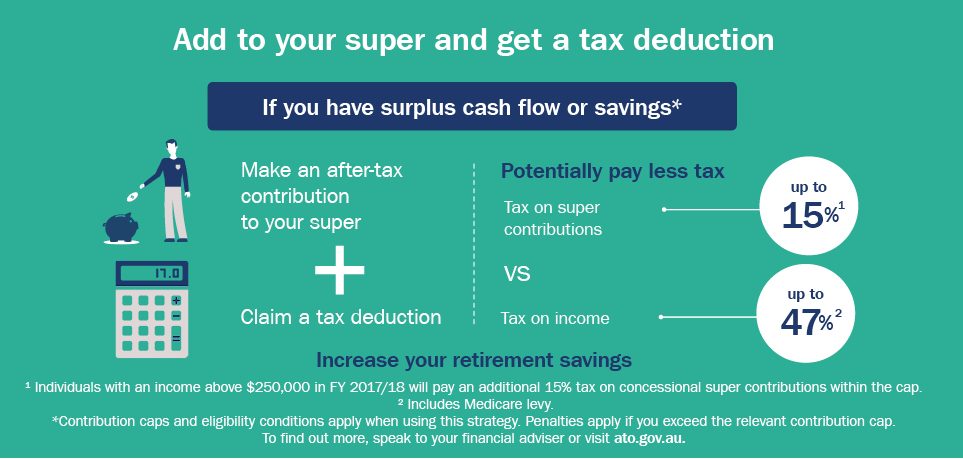

By making a personal super contribution and claiming the amount as a tax deduction, you may be able to pay less tax and invest more in super.

How does the strategy work?

If you make a personal super contribution, you may be able to claim the contribution as a tax deduction and reduce your assessable income.

The contribution will generally be taxed in the fund at the concessional rate of up to 15%¹,

instead of your marginal tax rate which could be up to 47%².

Depending on your circumstances, this strategy could result in a tax saving of up to 32% and

enable you to increase your super.

Note: From 1 July 2017, most people will be able to claim a tax deduction for personal

super contributions, regardless of their employment status.

How do you claim the deduction?

To be eligible to claim the super contribution as a tax deduction, you need to submit a valid ‘Notice of Intent’ form. You will also need to receive an acknowledgement from the super fund before you complete your tax return, start a pension or withdraw or rollover money from the fund to which you made your personal contribution.

Make sure you can utilise the deduction

It is generally not tax-effective to claim a tax deduction for an amount that reduces your assessable income below the threshold at which the 19% marginal tax rate is payable. This is because you would end up paying more tax on the super contribution than you would save

from claiming the deduction.

A key consideration

Personal deductible contributions count towards the ‘concessional contribution’ cap (which is $25,000 in the 2017/18 financial year) and tax penalties apply if you exceed the cap.

Seek advice

To find out whether you could benefit from this strategy contact Proxima Financial Planning and a registered tax agent.