Industry News

Enjoying your Retirement!

Do you know the key drivers to a happy and rewarding retirement?

You’ll be surprised to learn that it’s not always all about money. Uncover what most people think about when planning their retirement in our video message below.

Click here to find out

Is it time to consider the design of your super strategy?

To review how your retirement plan is tracking, please contact Helen and the Team at Proxima Financial Planning.

2024-25 Federal Budget

It’s that time of the year again when the Australian Government unveils the Federal Budget, setting the stage for the nation’s economic direction. We help you find out all you need to know in this 5-minute read. With the aid of a $9.3 billion surplus, Treasurer Jim...

RBA Release – Interest rates on hold but to stay higher for longer

As many predicted, The RBA released its latest rate decision to leave the cash rate unchanged at 4.35%. However, in light of the recent strong inflation data predicting that inflation will continue to stay high for some time yet, further rate hikes are still possible...

More good news……….!

At The RBA meeting held today, Philip Lowe’s penultimate board meeting as governor, the decision was made to leave the cash rate unchanged at 4.10% Inflation in Australia has passed its peak but will continue to remain high for some time yet. Growth has...

Markets jump as RBA meeting brings good news!

The Australian share market rose 0.4% or 31.7 points after The RBA’s decision to keep the cash rate unchanged at 4.1pc, after numerous interest rate increases since May last year. The still high interest rates are working to establish a more sustainable balance...

RBA rate rises back again!

The RBA hikes up the interest rate again to 4.25% - the highest cash rate since April 2012. Despite having passed the peak of inflation, RBA Governor, Philip Lowe, states that at 7%, inflation is still too high. Although The Board has said that Australian economic...

Be a smart gift-giver this holiday season

After a year like no other, many of us are looking forward to a relaxing holiday season shared with family and friends. Check out these easy ways to stretch your Christmas gift budget further, so you can enjoy more family time,...

Give a gift voucher to see a financial planner

Looking to give a meaningful gift that will bring more long-term benefits than the latest gadget? Did you know 4 in 5 young Australians would like to receive the gift of time with a financial planner? A financial plan created by a professional financial planner is the...

Give the gift that will last

Our new research report shows we’re keen to be giving gifts that can be enjoyed for longer. Find out how a financial plan can be a gift with benefits that last. Giving her daughter a financial plan for her 22nd birthday isn’t the first time Maryanne Cummins has chosen...

How do your gift giving habits compare? [Research Report]

Have you ever thought about how much you spend on gifts throughout the year? Did you know Australians spend nearly $20 billion a year on gifts? That’s about $1,200 each per year or $100 a month. New research* reveals other truly fascinating insights into how we think,...

What’s your Gift Giver Personality? (Quiz)

Happy birthday. Season’s greetings. Congratulations! From chucking confetti to winning with wine, there are likely dozens of gifts you’ll purchase for loved ones this year. So what kind of gift giver are you? New FPA national research reveals four distinct gift giving...

Financial Planning Week 2019

Every year, the Financial Planning Association (FPA) holds Financial Planning Week, to remind Australians about the benefits of financial planning. The theme for this year is “Gifts that Give”, which delves into Australia’s gift-spending habits. To celebrate Financial...

What the changes to the social security means test rules for lifetime income streams could mean for you

New law changing the assets and income test treatment of lifetime income streams commenced on or after 1 July 2019 is an important consideration for pre and post retirees and could change your Age Pension and retirement income outcomes. The social security assets...

Smart super strategies for this EOFY

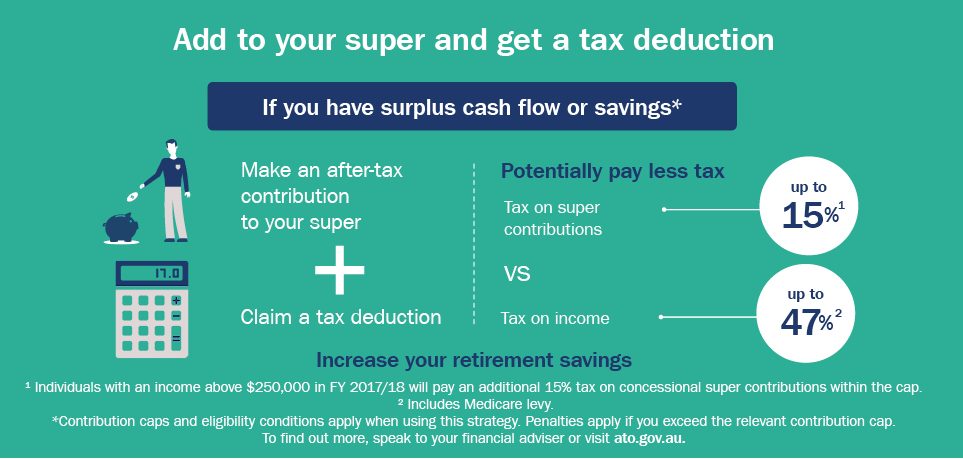

Want to help boost your retirement savings while potentially saving on tax? Here are five smart super strategies to consider before the end of the financial year. 1. Add to your super – and claim a tax deduction If you contribute some of your after-tax income or...

How well protected is your business?

If you’re like many business owners you have already insured the physical assets of your business from theft, fire and damage. But have you considered the importance of insuring yourself - and other key people in your business - against the possibility of death,...

Super solutions for women

Latest figures show Australian men can expect to retire with over a third more super than women. So why does this happen and what can be done about it? Alison Fischer CFP® Private Client Adviser for Crosbie Wealth Management and mum-to-be, shares her thoughts on what...

What will you do in retirement?

Keeping busy with work and family year after year can make it tricky to decide how to spend time in retirement. Discover ways to feel your best and make the most of life after work. Keeping active According to research from Sydney University, people who have retired...

Live for the moment vs save for the future

Want to boost your financial well-being without giving up completely on being spontaneous? Get on top of your finances and enjoy life more at the same time with our five step guide to living in the moment while saving for the future. Don’t be a slave to your savings...

Federal Budget 2019

2019 Federal Budget Analysis 2 April 2019 Treasurer Josh Frydenberg’s first Budget focuses on reducing the tax burden for the majority of working Australians, greater superannuation flexibility for retirees and a one off energy relief payment for eligible...

How are parents teaching kids the value of money in today’s digital world?

As part of their Financial Planning Week campaign, the FPA conducted national research with The Curious Co. The Share the Dream national survey of 1,003 Australian parents of children aged 4-18, gives new insights into our nation’s financial capability and readiness...

Planners as parents

When your work is all about helping people to manage their money better, does it help you teach your own kids good financial habits? We talked to three CERTIFIED FINANCIAL PLANNER® professionals about the ups and downs of passing on money wisdom to the next...

Financial Planning Week 2018

Every year, the Financial Planning Association (FPA) holds Financial Planning Week, to remind Australians about the importance of financial planning. The theme for this year is Share the Dream. We think it’s a great reminder of why we need a plan in place to realise...

Super strategies 2017/18 financial year

Make tax-deductible super contributions By making a personal super contribution and claiming the amount as a tax deduction, you may be able to pay less tax and invest more in super. How does the strategy work? If you make a personal super contribution, you may be able...

Budget 2018

2018 Federal Budget Analysis Scott Morrison’s third budget is headlined by $140 billion in tax cuts over the next decade, immediate tax relief of up to $1,060 a year for middle-income households and a fundamental reform of the tax system....

Thinking about self-managed superannuation?

Self-managed super offers many benefits to people with the right skills and enough time. If you want to own direct investments within superannuation or have a greater say in your wealth creation strategy, you might have considered starting a Self-Managed Super Fund...

Don’t work till you drop

With Australians now looking forward to 20 years or more in retirement, your super alone may not be enough to fund a comfortable retirement lifestyle. Here are some tips to help you build a bigger nest egg sooner — so you can retire when you want to, not just when you...

Still paying for insurance? Make sure it’s right for you

Your work life has come to an end, so it’s time to let go of the things you don’t need any more. You’ve probably ditched the work clothes and the briefcase and said goodbye to the 9 to 5 routine. But should you let go of your personal insurance too? Why have personal...

Maximise your super before 30 June

Did you know from 1 July 2017 the Federal Government is reducing the amount you can contribute to super each year? There has never been a better time to maximise your super. Make the most of the higher concessional contribution caps Concessional (before tax)...

10 Ways to Save Money this Christmas

With household budgets squeezed, many families are worried about covering the cost of Christmas this year, and don't want to take a debt hangover into the new year. It can be hard to manage and keep track of your expenses when Christmas is creeping closer and closer...

Mind the retirement gender gap

Employer initiatives, government policies, and legislation are all needed to help close the gender gap in retirement. While the Senate inquiry and Budget proposals seem to be paving the way, more needs to be done, Jessica Amir finds. It is no secret that women retire...

Proxima Community News

Our client Shirley and her late husband, Peter began decorating their home for Christmas 16 years ago. The decorations, which began with a simple string of lights above the front windows, have grown each year, where today there are hundreds of lights, ornaments and...

Market Update December 2016

Markets were boosted by Donald Trump's election victory. Investors bet that his policies will be better for business and lead to stronger US economic growth. Oil prices rose 5.5% to US$49.41 per barrel (WTI). The US economy continues to perform well and interest rates...

The Sandwich Generation

This is the Sandwich Generation: people in their 40s and 50s caught between the demands of aging parents and dependent children. Caring for two generations at once can create new financial pressure on your household — so here's how to lighten your load. The financial...

To Downsize or Not?

The kids have moved out and the house is starting to feel empty — as well as costing a lot to maintain. So is it time to sell up and buy something smaller? We look at the pros and cons of downsizing the family home. If you're an empty nester or retiree who owns their...

Avoid a Retirement Lifestyle Crisis

While you're working, with money coming in, you can probably afford to live life the way you choose. But what will happen to your lifestyle when you retire? When you're used to a certain standard of living, it can be a shock if you can no longer afford to live that...

2016-17 Federal Budget for Women

Women who take time off work to have children have largely been recognised as struggling when it comes to saving for their retirement. The government is now trying to help them build up their super by refunding tax paid on super contributions while they are living on...

2016-17 Federal Budget for Older Australians

Aged care providers will lose $1.2bn over four years to help curb a predicted blowout of $3.8bn in costs in the residential aged-care system. However, transitional assistance gains $53.3m and the My Aged Care web portal will receive a $137m boost. The budget papers...

Easy Guide to Budgeting

What is a budget? A budget is a plan that works out how you will manage your income and expenses. Maintaining a budget is a powerful way to control your money. Read the full article for budgeting tips and to access your free copy of the Proxima Budget Template Do you...

CONTACT

Phone: 08 8332 4700

Fax: 08 8431 4365

Email: info@proximafg.com.au

Address: Level 2, 135 Fullarton Road Rose Park, 5067 South Australia

STRATEGIC ADVICE IN:

Wealth creation, Retirement planning, Investments, Superannuation, Insurance, Aged care, Wills and succession planning, Business agreements, Debt Restructuring.

READY TO LEARN MORE?

Proxima Financial Group Pty Ltd | ABN 69 108 042 708 | T/a Proxima Financial Planning is a Corporate Authorised Representative (ASIC Number 269744) of Paragem Pty Ltd | ABN 16 108 571 875 | AFSL & ACL Number 297276 | www.paragem.com.au.

Paragem's email is: info@paragem.com.au and their phone number is: 02 8036 6490.

View our Financial Services Guide (Part 1 and Part 2), Complaints Process, General Advice Warning and Privacy Policy here.

![How do your gift giving habits compare? [Research Report]](https://proximafg.com.au/wp-content/uploads/2019/08/Research-Report-image-400x250.jpg)